Sustainability programs face challenging tensions that complicate their ability to gain traction and perform. The resulting trade-offs need to be seen in stark relief as they will define the course of your programs for years.

Performance: Financial versus Sustainability Performance

Cadence: Quarterly reporting cadence vs the 3-5 year long-term planning in sustainability

Organization: separate sustainability efforts versus fully integrating sustainability into operations.

We break these tensions down to identify the polarities that lie at each side and consider the middle-ground options that can overcome these unwieldy problems.

Performance: Financial vs Sustainability Performance

It is hard to reconcile the here-and-now focus of shareholders with the long-term strategic arc of sustainability. This tension is already playing out. More than 33% of CFOs in one study have pulled back sustainability investments to hit financial goals. Leaders must build durable programs without compromising economic viability.

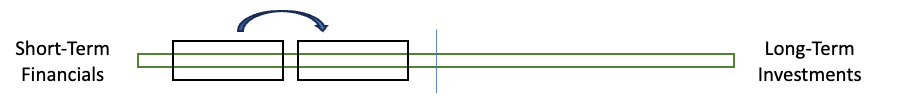

At one extreme is a complete focus on short-term financials; at the other is a complete focus on a long-term sustainability investment plan. What more balanced option makes the most sense? The early focus should be on financial performance: initiatives such as reduction in Scope 2 energy costs, that show financial performance and build trust.

One way to guide this is to portfolio manage initiatives through their expected financial and sustainability impact and through their expected cost and risk profile. The goal can be to always have a limited set of “hard” initiatives in place with multiple “easy” initiatives to drive consistent performance.

The cadence of cost vs consequence tension: budgeting costs and measuring returns

A similar tension relates to cadence: the well-understood financial quarterly cadence versus the long-term investment view of sustainability. Quarterly financial reporting processes and annual budgeting are ingrained into the operations; sustainability creates tension:

- The long-term nature requires some multi-year budget commitment as initiatives are likely to transcend the annual budgeting

- Finance likely wants to understand performance and expected returns on a more frequent basis than annually so resource reallocation can happen at faster intervals.

A way to do this is through a working capital process that provides committed long-term capital to create a productive level of multi-year budget confidence, allocated on a base level annually as part of budgeting, but is gated quarterly to closely monitor (and reallocate if needed) performance and returns. This:

- Enables organizations to adapt to changing internal and external factors – optimizing resource allocation accordingly and

- Allows more open, continual communication of sustainability progress and challenges to stakeholders, thus building trust and loyalty.

The body vs limb tension: moving from isolation to integration

Sustainability is not really an initiative: for most companies it will be an operational norm for years to come. And yet, it is still alien to most, raising the question: what organizational structure is more efficient and productive?

At one extreme is sustainability as a peripheral or distinct activity, driven by external pressure, compliance or marketing; at the other is sustainability as a central or essential activity, driven by internal purpose or innovation. Neither works.

We believe most organizations should move to more of a federated model over the next few years: an empowered and resourced sustainability program comprising sustainability and functional leaders to drive strategy and ensure performance, matrixed to the operational elements that lead the execution through the functions.

The way forward

Sustainability is becoming a new strategic and operational imperative. Questions arise as to how to balance financial and sustainability performance, manage capital allocation, and create the best structure to deliver efficient and predictable results. It is daunting, but working out how and where the business is on these scales is a crucial step to moving along it.