Sustainability is unavoidable because of regulation and customer pressure, and disruptive. So how do you make a strategy calibrated to risk that uses capital wisely?

Our solutions help you minimize risks or capitalize on the opportunities presented by sustainability

Sustainability strategies

Sustainability is a disruptive and unavoidable dynamic – whether you are subject to emerging regulations or under commercial pressure from downstream customers. It presents a new wave of financial, operational, and reputation risk for virtually all companies across all industries.

For some, notably those in cleantech, climate tech, and those who have already switched out materials to bring environmentally friendly products to market, sustainability creates new possibilities to accelerate growth.

But for most, it has not been core to the strategy, not in the budget, and not a core competency. And on a practical basis, other priorities command executive attention and budget resources. So how do you create a strategy that is calibrated to risk and uses capital wisely?

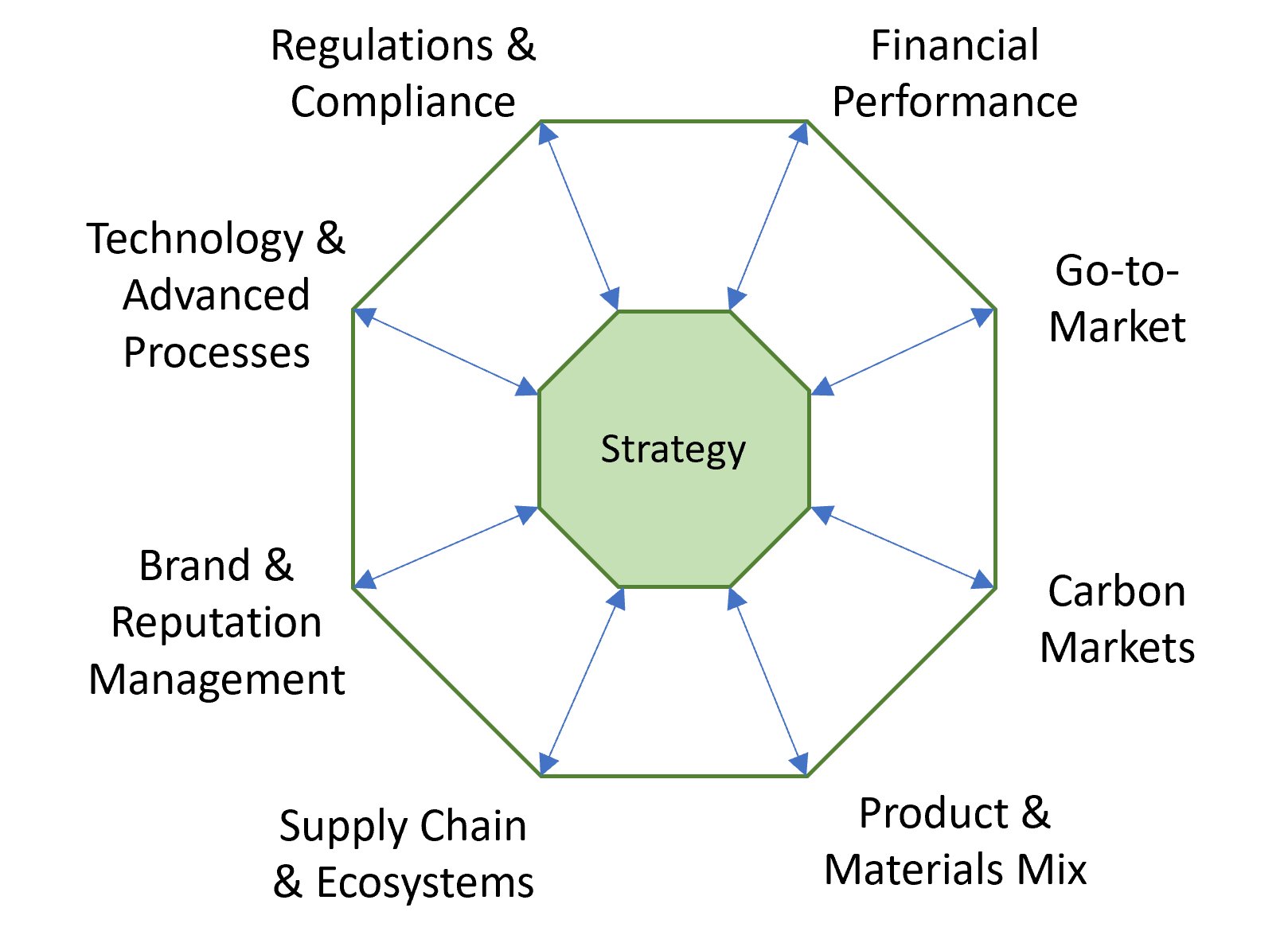

Cairnbridge Advisors helps you build sustainability strategies that minimize risk and capitalize on emerging opportunities. Our approach translates sustainability to financial, operational, and reputational risk so you have a clear sense of what’s at stake, how best to adapt to a new business imperative, and how to integrate sustainability practices into core operations to achieve efficiency at scale.

Risk Modeling

Sustainability is an unfamiliar and disruptive dynamic. And although it creates immediate measurement and reporting risks for companies subject to regulations, the most pressing risks are likely financial.

And these risks will affect your business whether you are directly subject to regulations or subject to commercial pressure from downstream customers. Those operating in supply chains will increasingly see customers convert emissions to carbon costs, meaning your emissions will increasingly translate to loss of pricing power or loss of wallet share.

But the reality is that today’s risks are relatively modest and can mislead business leaders as to what is around the corner. Business risks, such as financial, operational, customer, reputational, and valuation risks, will increase as regulations take hold, the cost of carbon drives action, and consumers and downstream customers change purchasing behaviors.

Cairnbridge Advisors helps our clients model risks, assessing and forecasting risk as part of or independent of your current enterprise risk management processes. By modeling risk, you gain a clear sense of what’s at stake and identify proportional investments to minimize risk.

Financial Modeling

Sustainability ultimately translates to financials, whether as a threat to margin performance or as new opportunities to accelerate growth. But the financial reality is complex and dynamic, requiring you to minimally consider:

- The emerging cost of carbon standards unaddressed by COP28 and now being driven by industry groups such as the International Maritime Organization (IMO)

- The effect of carbon costs on key costs to your business including energy, transportation and logistics, and material costs

- Evolving consumer and downstream behaviors that will influence areas like pricing power and market share

- If and how sustainability will affect the cost of money and valuation.

But models can’t be generic or top-down in nature, only giving hints to the risks or benefits. Financial models need to be geared to the specific business drivers that shape market and financial performance.

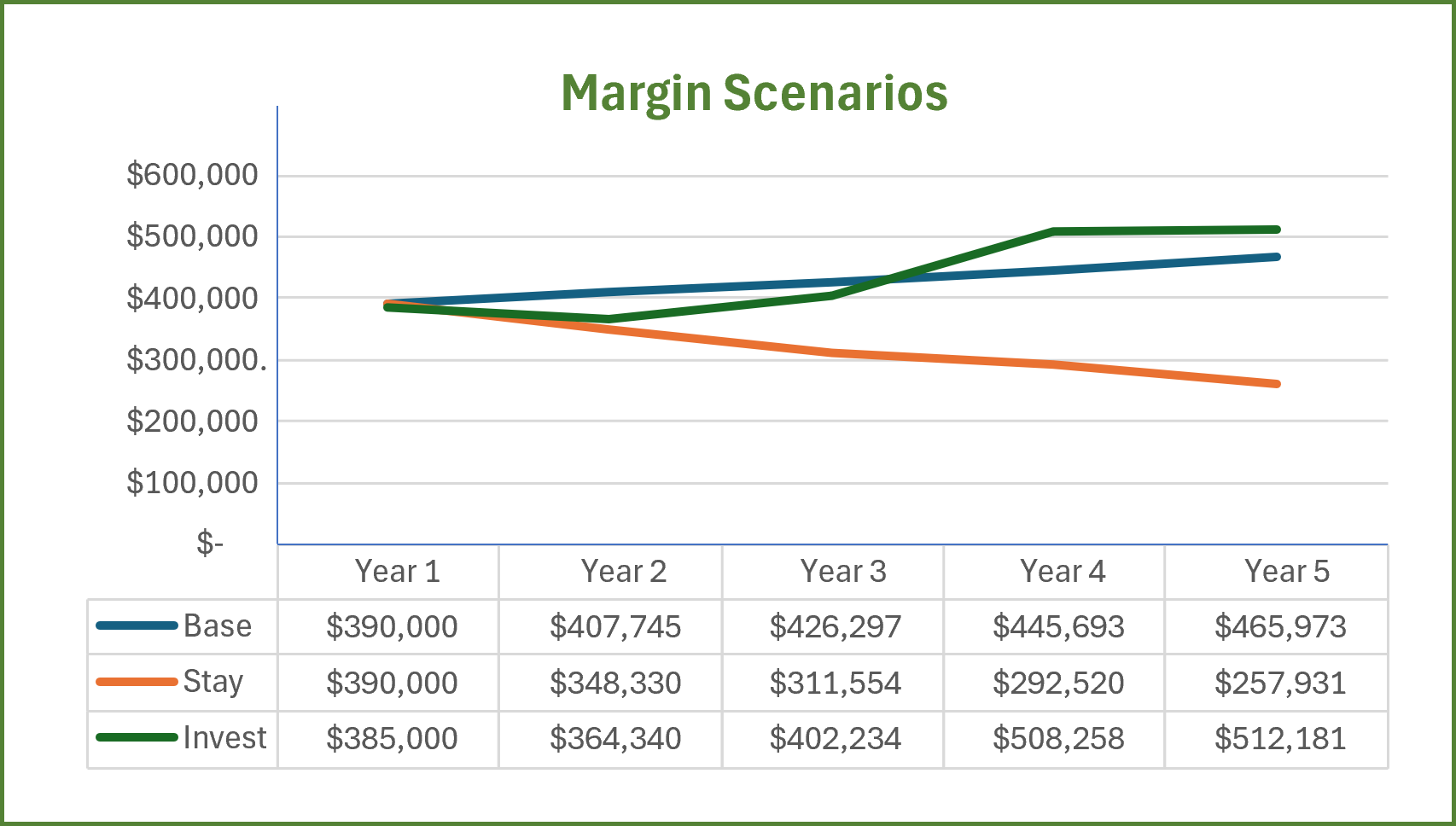

Cairnbridge Advisors develops financial models with our clients that consider the wide variety of inputs driven from sustainability and tie directly to the business drivers determining your financial performance. The results are 5-year models that enable you to understand the impact of sustainability from a volume, cost, revenue, and margin standpoint, and model levers that can minimize risk or create opportunities in different scenarios.

Go-to-Market Strategies

Sustainability presents new growth opportunities, whether you are driving growth in cleantech and climate tech, or you are seeking to accelerate revenue and margin growth by bringing more environmentally friendly products to market. But selling into the sustainability market has challenges:

- Margin pressures will place cost as a primary consideration

- The “newness” of these types of purchases means senior management is more likely to be involved

- The economic buyer is central to address business cases they may have little precedence

- Buyers are unsure that consumers will bias environmentally friendly products or be willing to pay for premiums for those products

- Buyers will have high dependency (and expectations) that your sales teams are fluent in sustainability – from regulations to the science of emissions to virtual carbon markets and associated credits.

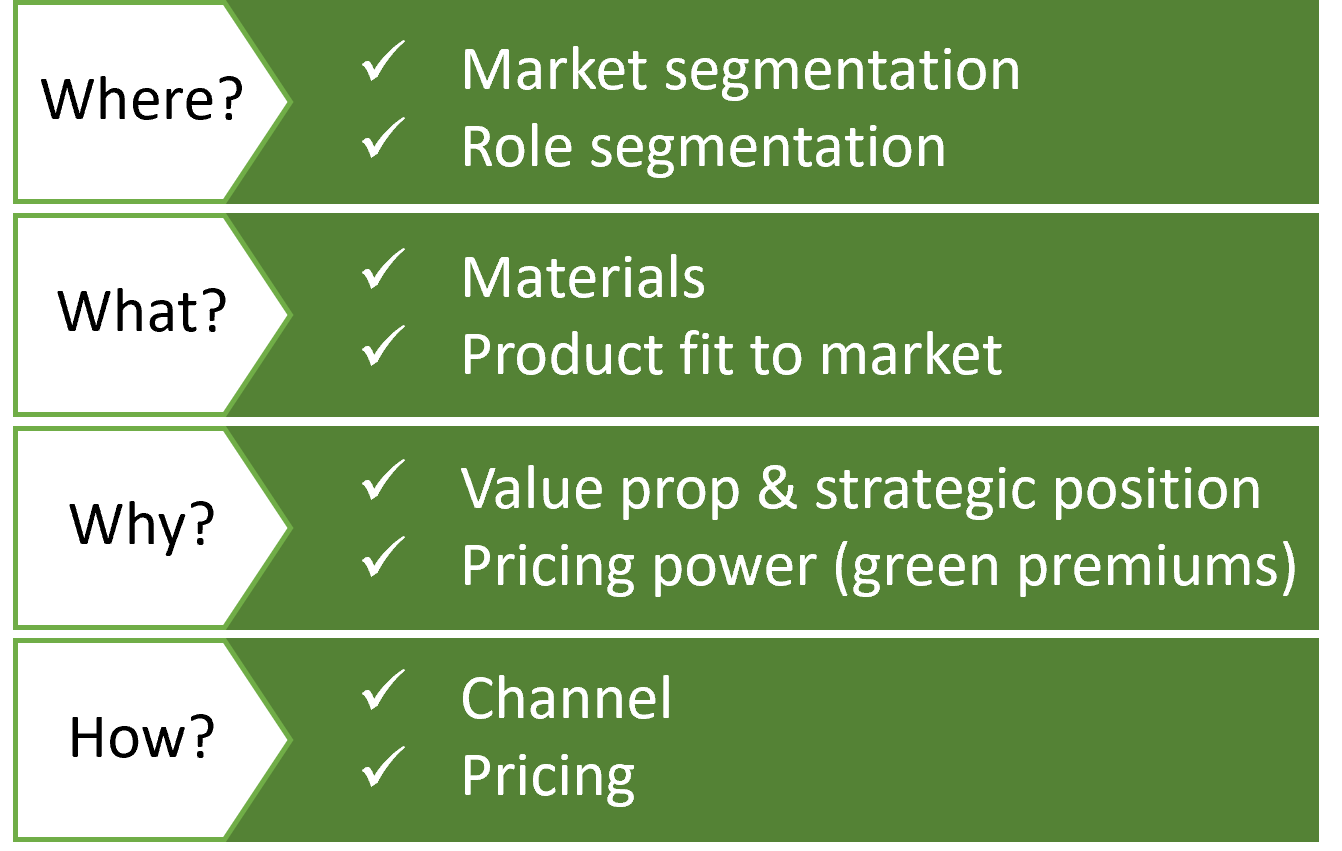

For you to realize the potential of the sustainability market, you will need to adapt your go-to-market model.

Cairnbridge Advisors helps companies seize on the emerging market opportunity. This includes sizing the market opportunity, positioning your solution, protecting the price premium, aligning to buyer’s priorities and preferences, and adapting your go-to-market/commercial strategies to maximize the available revenue opportunity.